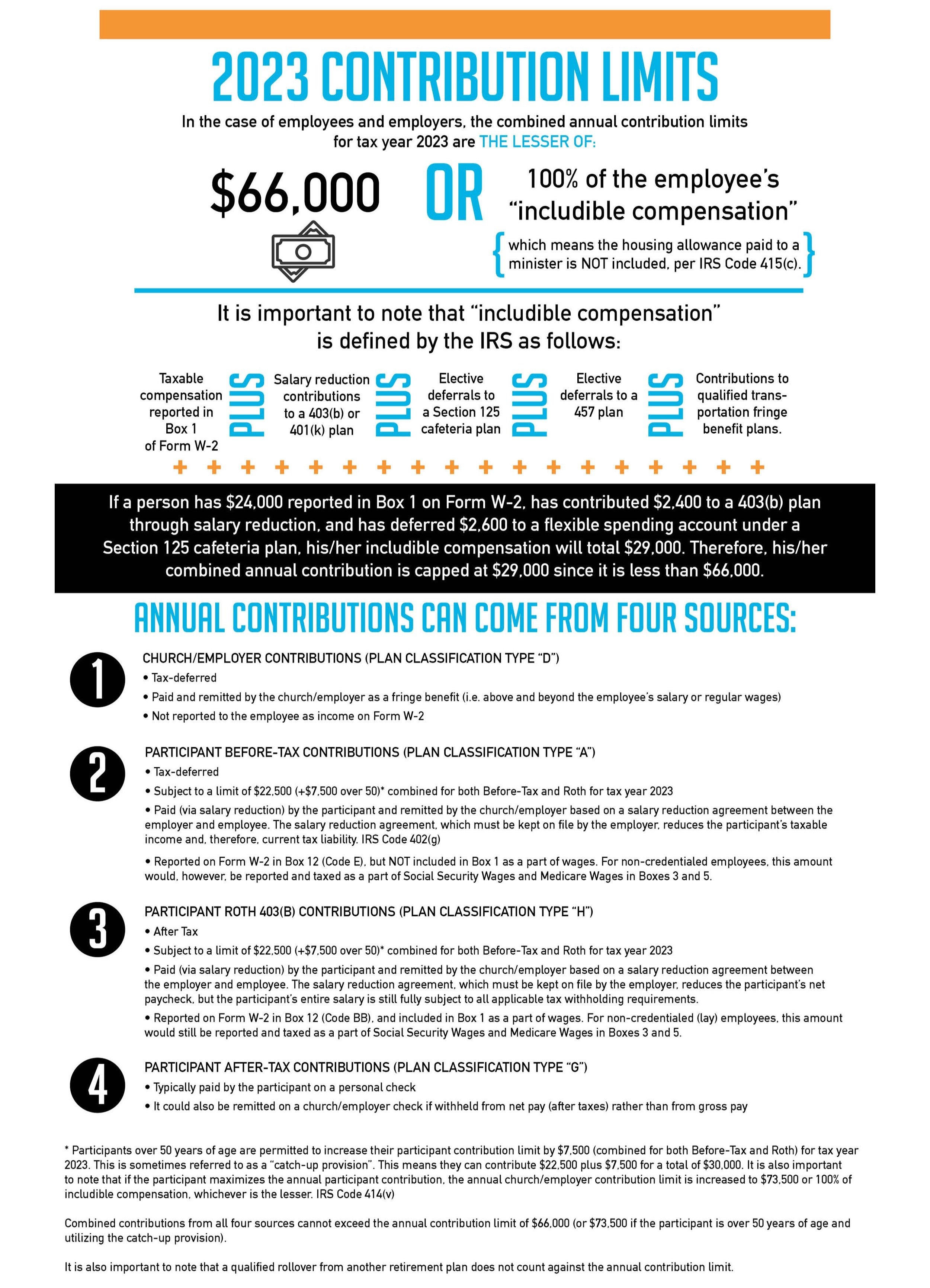

2023 Contribution Limits

In the case of employees and employers, the combined annual contribution limits for tax year 2023 are:

The lesser of $66,000 or 100% of the employee’s “includible compensation,” which means the housing allowance paid to a minister is NOT included, per IRS Code 415(c).

It is important to note that “includible compensation” is defined by the IRS as follows:

Taxable compensation reported in Box 1 of Form W-2, plus

Salary reduction contributions to a 403(b) or 401(k) plan, plus

Elective deferrals to a Section 125 cafeteria plan, plus

Elective deferrals to a 457 plan, plus

Contributions to qualified transportation fringe benefit plans.

Here is an example of how “includible compensation” is calculated:

If a person has $24,000 reported in Box 1 on Form W-2, has contributed $2,400 to a 403(b) plan through salary reduction, and has deferred $2,600 to a flexible spending account under a Section 125 cafeteria plan, his/her includible compensation will total $29,000. Therefore, his/her combined annual contribution is capped at $29,000 since it is less than $66,000.

Annual contributions can come from four sources:

1. Church/Employer Contributions (Plan classification type “D”)

Tax-deferred

Paid and remitted by the church/employer as a fringe benefit (i.e. above and beyond the employee’s salary or regular wages)

Not reported to the employee as income on Form W-2

2. Participant before-Tax Contributions (plan classification type “A”)

Tax-deferred

Subject to a limit of $22,500 (+$7,500 over 50)* combined for both Before-Tax and Roth for tax year 2023

Paid (via salary reduction) by the participant and remitted by the church/employer based on a salary reduction agreement between the employer and employee. The salary reduction agreement, which must be kept on file by the employer, reduces the participant’s taxable income and, therefore, current tax liability. IRS Code 402(g)

Reported on Form W-2 in Box 12 (Code E), but NOT included in Box 1 as a part of wages. For non-credentialed (lay) employees, this amount would, however, be reported and taxed as a part of Social Security Wages and Medicare Wages in Boxes 3 and 5.

3. Participant roth 403(b) Contributions (Plan classification type “H”)

After Tax

Subject to a limit of $22,500 (+$7,500 over 50)* combined for both Before-Tax and Roth for tax year 2023

Paid (via salary reduction) by the participant and remitted by the church/employer based on a salary reduction agreement between the employer and employee. The salary reduction agreement, which must be kept on file by the employer, reduces the participant’s net paycheck, but the participant’s entire salary is still fully subject to all applicable tax withholding requirements.

Reported on Form W-2 in Box 12 (Code BB), and included in Box 1 as a part of wages. For non-credentialed (lay) employees, this amount would still be reported and taxed as a part of Social Security Wages and Medicare Wages in Boxes 3 and 5.

4. Participant After-Tax Contributions (Plan classification type “G”)

Typically paid by the participant on a personal check

It could also be remitted on a church/employer check if withheld from net pay (after taxes) rather than from gross pay

* Participants over 50 years of age are permitted to increase their participant contribution limit by $7,500 (combined for both Before-Tax and Roth) for tax year 2023. This is sometimes referred to as a “catch-up provision”. This means they can contribute $22,500 plus $7,500 for a total of $30,000. It is also important to note that if the participant maximizes the annual participant contribution, the annual church/employer contribution limit is increased to $73,500 or 100% of includible compensation, whichever is the lesser. IRS Code 414(v)

Combined contributions from all four sources cannot exceed the annual contribution limit of $66,000 (or $73,500 if the participant is over 50 years of age and utilizing the catch-up provision).

It is also important to note that a qualified rollover from another retirement plan does not count against the annual contribution limit.