Emotions and Your Retirement Investments

by Bob Haymond, CFP®, Vice President of Financial Planning and Strategy

We have seen some big swings in the stock market the past five months. As a result, Servant Solutions has talked with several of our participants about these market changes. I am happy to report that the majority of those I spoke with (A) know where to place their faith, (B) are not panicking, (C) know to wait it out, and are (D) keeping the long-term outlook in mind. I believe a factor that helped was the experience of the stock market conditions in 2008 and 2009. That event is still fresh in our minds, and we saw how the market recovered after that significant downturn. We do not know what the future holds. We may still have a long way to go and may experience some more bumps along the way. Today we face inflation and uncertainties caused by war in Europe. Tomorrow, it will be another storm. No matter what questions you have about the future, we are here to help you craft a solid plan for your retirement years.

To assure our participants that we are looking out for your best interests, Servant Solutions uses Ronald Blue Trust as our investment advisors. Here are some good reminders from them:

Emotions are normal; responding can be detrimental. Not every market action requires us to take an action. An action driven by emotion can be harmful.

Long-term plans are built for uncertain times. A financial plan that evaluates the short, medium, and long-term is something to lean on during uncertain times.

Investors are rarely right twice. Studies show that attempting to exit and enter the market to avoid turbulent periods—called market timing—has a poor record of success.

You are only rewarded if you are present; market declines give way to market rebounds. If you did not stay invested, you will not benefit from those recoveries.

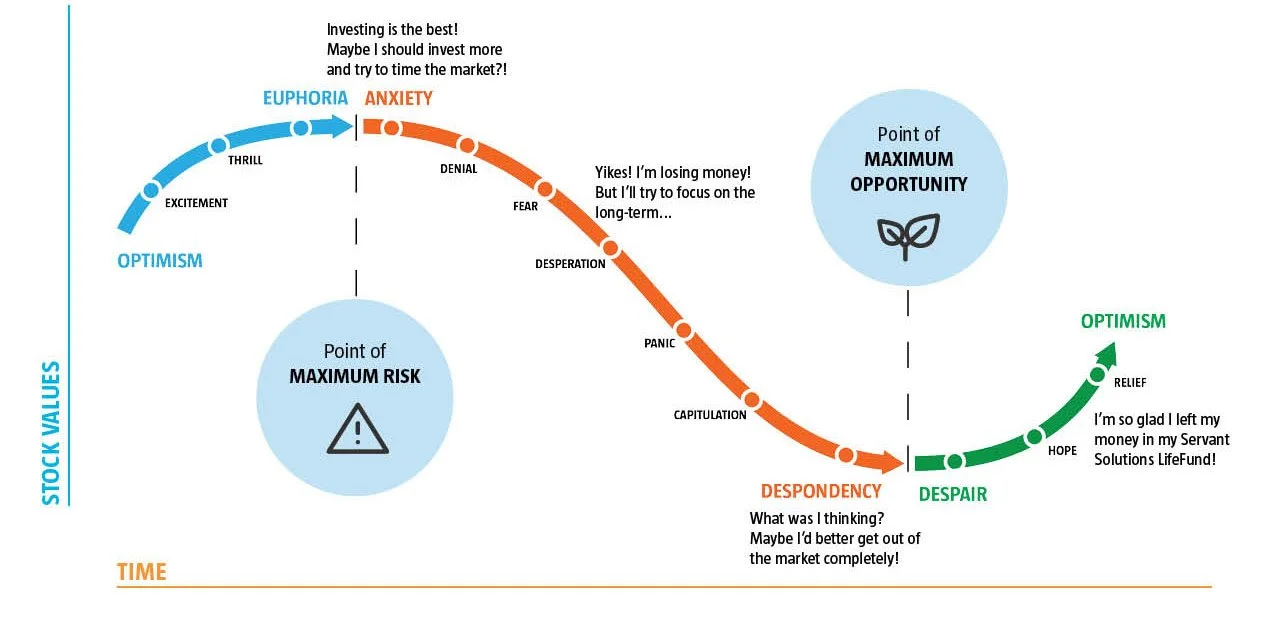

In addition, below is a graph that shows our natural emotions when it comes to investing. It is because of our emotions that we tend to not buy and sell at the most opportunistic times.

It’s Easy to Let Emotions Get in the Way

Having a plan and sticking to it can help you avoid common mistakes, such as buying and selling at the wrong time out of panic or exuberance.