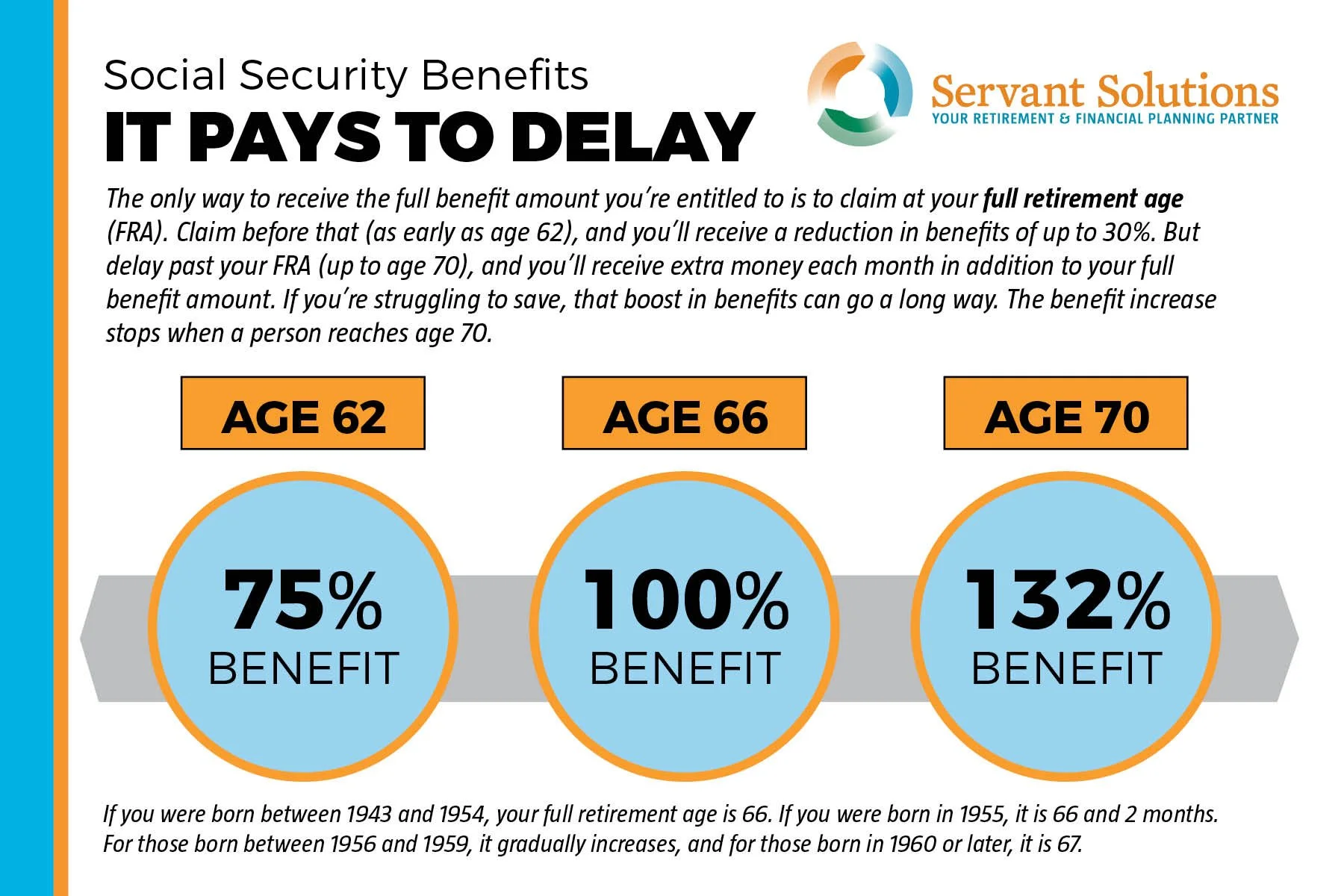

In our conversations with pastors, we find many consider taking Social Security before full retirement age. Maybe they’re unaware of a little secret–delaying the start of Social Security benefits typically means you’ll receive more money in retirement. And here’s additional incentive to delay: the big cost-of-living adjustments (COLA) made in the last two years will bring an even greater advantage.

Even if you don’t collect benefits now, the 8.7% COLA will still factor into the amount you’re eligible to receive starting at age 62. The adjustment gets compounded every year, so if you wait until full retirement age or later, your monthly payment will grow even more. By delaying benefits you'll earn 8% more on top of the COLA-adjustment for each year until age 70, when your benefits max out. There is no additional benefit increase after you reach age 70.

Planning to maximize Social Security is important considering this benefit lasts the extent of our life and will adjust for inflation. The same can’t be said for most other sources of retirement income. About half of Americans 65 or older rely on Social Security at least 50% of their household income and a quarter it’s 90% of their income. “Some may be tempted to cash in on more robust payments, that increase is one more reason for people nearing retirement to delay claiming their Social Security benefits.” said Brian J. O’Connor of Yahoo Finance.

You probably already know that you'll take a permanent cut if you claim benefits before your full retirement age. Take Social Security when you need the benefit, but for those that can wait here’s an example from a Bloomberg article by Alexis Leondis. Let's say a 64-year-old retiree is eligible for a primary insurance amount of $3,000 per month at full retirement age. If she didn't collect last year, when the COLA was 5.9%, her benefits would have been adjusted to $3,177. The amount will get bumped up to $3,453 next year (with the latest COLA increase being applied to the higher inflation-adjusted amount). COLAs keep getting added the more years she waits; any delayed credits for not collecting benefits from full retirement age until age 70 are then applied on top of that amount. If she delays her benefits until age 70, then her monthly benefit (excluding any COLAs beyond next year) will be $4,374.

There’s a lot to think about—and plan for—when it comes to retirement, and the decision of when to start taking Social Security benefits is a highly individual question. If you can afford to wait, we encourage you to do so. As always, we’re here if you would like to discuss your options. The choices you make today impact the quality of your financial life tomorrow, and Servant Solutions wants to help you plan wisely for the future.